Understanding Private Credit’s Attraction

The United States is centerfold in credit portfolios. Oaktree Capital recently cited that the country has “the most accommodative capital markets in the world.” As reviewed in Great Point Capital’s August newsletter, there are numerous factors that contribute to private credit’s desirability in the current investment climate.

Key Takeaways

Generally, private credit is less liquid than high-yield bonds. The latter is traded on public exchanges, but may face volatility.

The total value of private markets increased more than twofold from $6.88 in 2019 to $14.24 trillion in 2024.

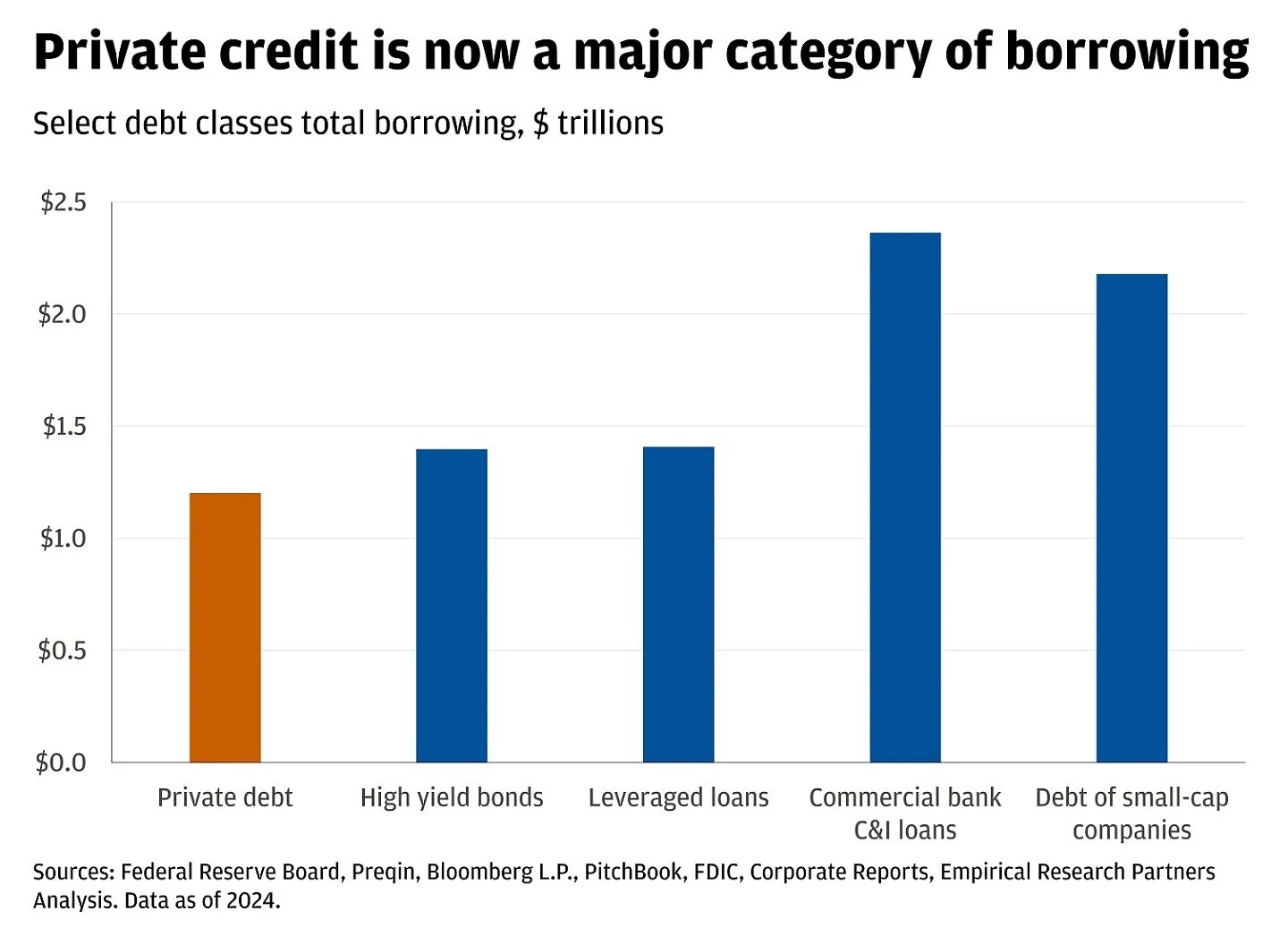

Since 2021, private credit has been the leading asset in private markets.

One Great Point: When considering private credit or other asset classes, weighing their differences and volatility is an imperative step before allocating to them as part of a diversified portfolio.

Source: J.P. Morgan